26+ Sales Tax Calculator Reverse

Quebec Tax Tip is a simple application that calculate GST QST and tip. This Canada sales tax calculator Calcul Taxes Canada is easy to use simple and has been designed with simplicity in mind so you can quickly calculate the total cost before or after taxes.

Reverse Sales Tax Calculator

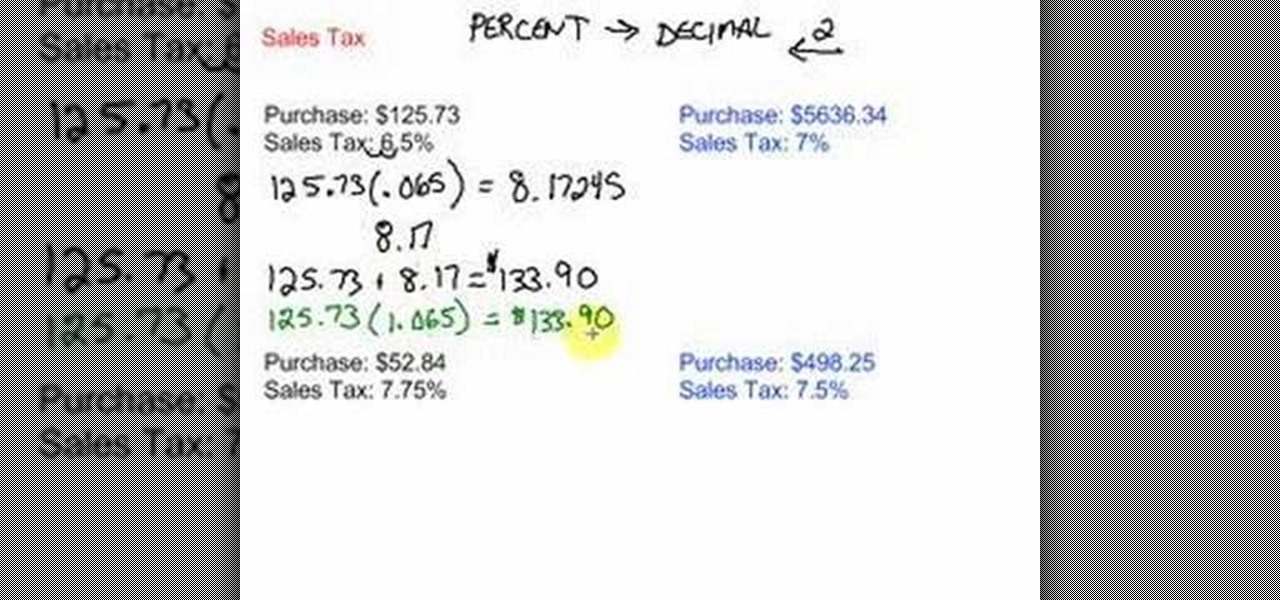

To easily divide by 100 just move the decimal point two spaces to the left.

. Sales tax list price sales tax rate Total price including tax list price sales tax or Total price including tax list price list price sales tax rate or Total price including tax list. Enter the sales tax percentage. The formula looks like this.

The GST rate was decreased from 7 to 5 between 2006 to 2008. Reverse tax calculator included. Here You Can See Both methods But we Also Included the Sales.

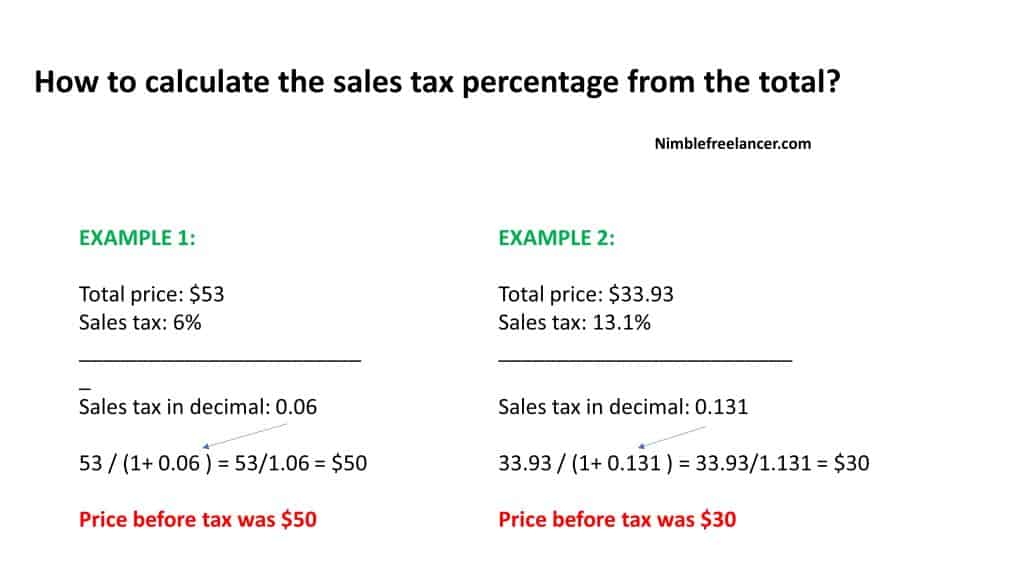

Tax 26 0075. Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if. Reverse Sales Tax Calculation In Reverse Sales There Are Two Things To Calculate Price After Tax And Price Before Tax.

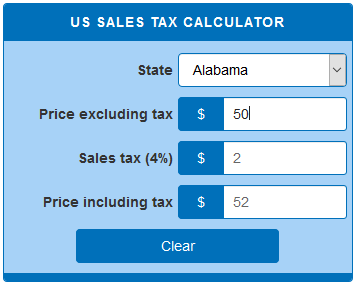

Tax 195 tax value. In our example let us make it 4. Meanwhile the sales tax rate itself is calculated by dividing the sales tax percentage by 100.

Price before Sales Tax. After 1996 several provinces adopted HST a combination of PST and GST into a single value-added tax. The final price including tax 26 195 2795 Sales tax Formula Final Price.

This free mobile app is the simplest way to calculate your Quebec sales tax. Now find the tax value by multiplying tax rate by the before tax price. Real Estate Agents In Faridabad Property Dealers.

It can be speculated he is a member of 𝑖s Team. Calculator formula Here is how the total is calculated before sales tax. Find out the net price of a product.

Tax 26 0075 tax 195 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. Amount with taxes Canada Province HSTQSTPST variable rates Amount. How to calculate sales tax with our online sales tax calculator Find out the sales tax rate.

Reverse Sales Tax Formula. Before-tax price sale tax rate and final or after-tax price. Calculate the canada reverse sales taxes HST GST and PST Do you like Calcul Conversion.

Similarly a gross of 5225 in the same region would reverse to 50. For instance in Palm Springs California the total. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount.

The formula looks like this. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

26 Sales Tax Calculator Reverse Sabtu 14 Januari 2023 There are 26 sporadic groups. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

Fastest Sales Tax Reverse Calculator 2022 2023

Us Sales Tax Calculator Calculatorsworld Com

How To Calculate Sales Tax Backwards From Total

How To Figure Out And Calculate Sales Tax Math Wonderhowto

How To Add Sales Tax 7 Steps With Pictures Wikihow

Find Sales Tax And Total Amount Youtube

Reverse Sales Tax Calculator Calcurator Org

How To Calculate Reverse Sales Tax Bizfluent

Sales Tax Calculator Double Entry Bookkeeping

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

How To Add Sales Tax 7 Steps With Pictures Wikihow

4 Ways To Calculate Sales Tax Wikihow

.jpg)

Document Viewer Development Code

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax Youtube

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax Backwards From Total Pocketsense